Analyst Weekly, May 19, 2025

Global markets are flashing signals that matter for the road ahead, and savvy investors are paying attention. From AI expansion into new regions to retail turning profitable and governments recalibrating trade and taxes, the next phase of the cycle is taking shape. Here’s what’s moving markets and what it means for your portfolio.

Uncle Sam’s Not AAA Any More

Moody’s just pulled the US’s final AAA rating, citing ballooning debt, a $2T+ annual deficit, and political gridlock over taxes and spending. But for many in the market, this was already priced in. The 27-year era of fiscal stimulus ended in 2023 and net interest payments have quietly climbed to 18% of tax revenues, far above historic norms. It is clear that tariffs and paying for tax cut extensions are signs that a new period of austerity has arrived.

The irony? Moody’s might be late to the party. In 2011, S&P downgraded the U.S. after Congress passed $2T in cuts. Bond yields fell. Now, Moody’s is flagging deficits tied to tax cut extensions that haven’t even passed while ignoring tariffs, which function as a $2T consumption tax that actually supports revenue. Tariffs hurt growth, but they help the Treasury: a trade-off the market seems to understand better than the rating agencies. Investor Takeaway: The downgrade reflects what markets already know: we’re in a new fiscal regime defined by austerity via tariffs and caps, not stimulus. Keep an eye on Treasury yields and fiscal negotiations but don’t overreact to the downgrade itself. History shows these calls often lag the fundamentals.

Britain’s Big Beat, Meet Big Breach

The UK kicked off 2025 with a bang: GDP rose 0.7% q/q in Q1, topping forecasts and leading the G7. Strong consumer spending and industrial output did the heavy lifting, giving the government a narrative win. While questions remain around fresh tax increases and trade tensions, the growth beat shows the UK economy still has momentum. In other words, Britain’s economy is winning the sprint, but the marathon has obstacles ahead (trade policy being a key one).

Meanwhile, a very 2025 problem hit a British retail icon. Marks & Spencer (MKS.L) was sidelined by a massive cyberattack that knocked out its website and app for over three weeks. The ransomware-style attack left M&S unable to take online orders since late April, with some store shelves even running low as systems went offline. The retailer confirmed hackers stole certain customer data (thankfully no payment info) and disruption has cost it an estimated £30+ million in profit so far. M&S shares have tumbled about 14% since the Easter weekend when the cyber woes began. The company is working to get operations back to normal, but the incident is a blunt reminder that even century-old brands need cutting-edge cyber defenses. Investor Takeaway: A strong economy doesn’t immunize companies from tech threats: investors in the UK market must balance the encouraging big picture (robust GDP, improving sentiment) with due diligence on company-specific vulnerabilities (like cybersecurity resilience). Keep an eye on trade policy moves too, as any post-truce tariff flare-up could quickly turn Britain’s surprise boom into a bust.

Source: Bloomberg, As of May 18, 2025.

Desert Deals Fuel AI Chip Rally

Walmart Finally Cashes In Online

Copper: Electrified, Scarce, and (Slightly) Tariffed

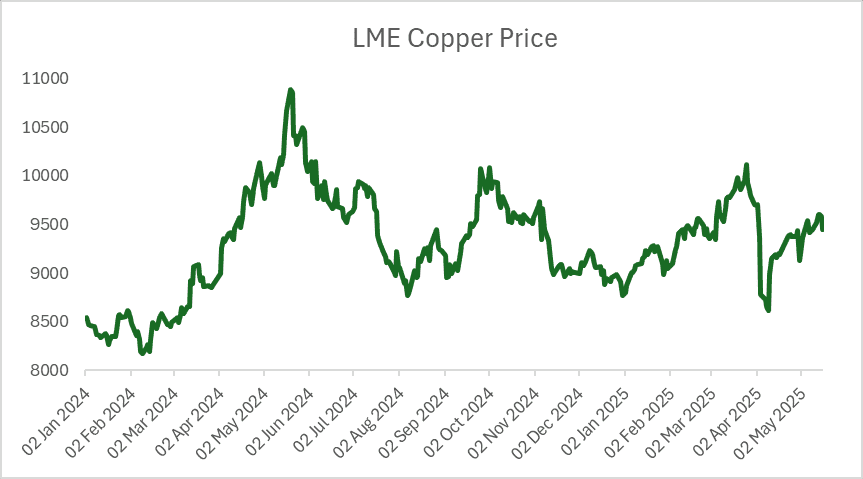

Copper just got hotter. Structurally, demand is being supercharged by everything from EVs and solar panels to AI data centers (yes, servers need serious power). China, which buys over half the world’s copper, has rolled out infrastructure-heavy stimulus for 2025, adding more fuel to the fire. But supply? That’s where it gets tight. Chile and Peru (which mine 40% of global copper) are battling falling ore quality, political disruptions, and water shortages – a mix that’s slowing down production just as demand ramps.

Then came a curveball: the US is potentially (not yet imposed) implementing a 25% tariff on copper imports, spooking traders and temporarily flooding inventories, which sent prices tumbling. A 90-day truce with China has helped stabilize sentiment, but the market’s still edgy. Investor Takeaway: For investors, the setup remains complex: structurally bullish, but tactically volatile. UK-based exposure ranges from direct copper exposures like WisdomTree Copper, to diversified miners (ANTO.L, GLEN.L, RIO.L) and broader natural resources funds (BRWM). Each brings different sensitivities to copper price shifts and to the policy risks now baked into the trade.

Source: Bloomberg, data as of May 18, 2025.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.